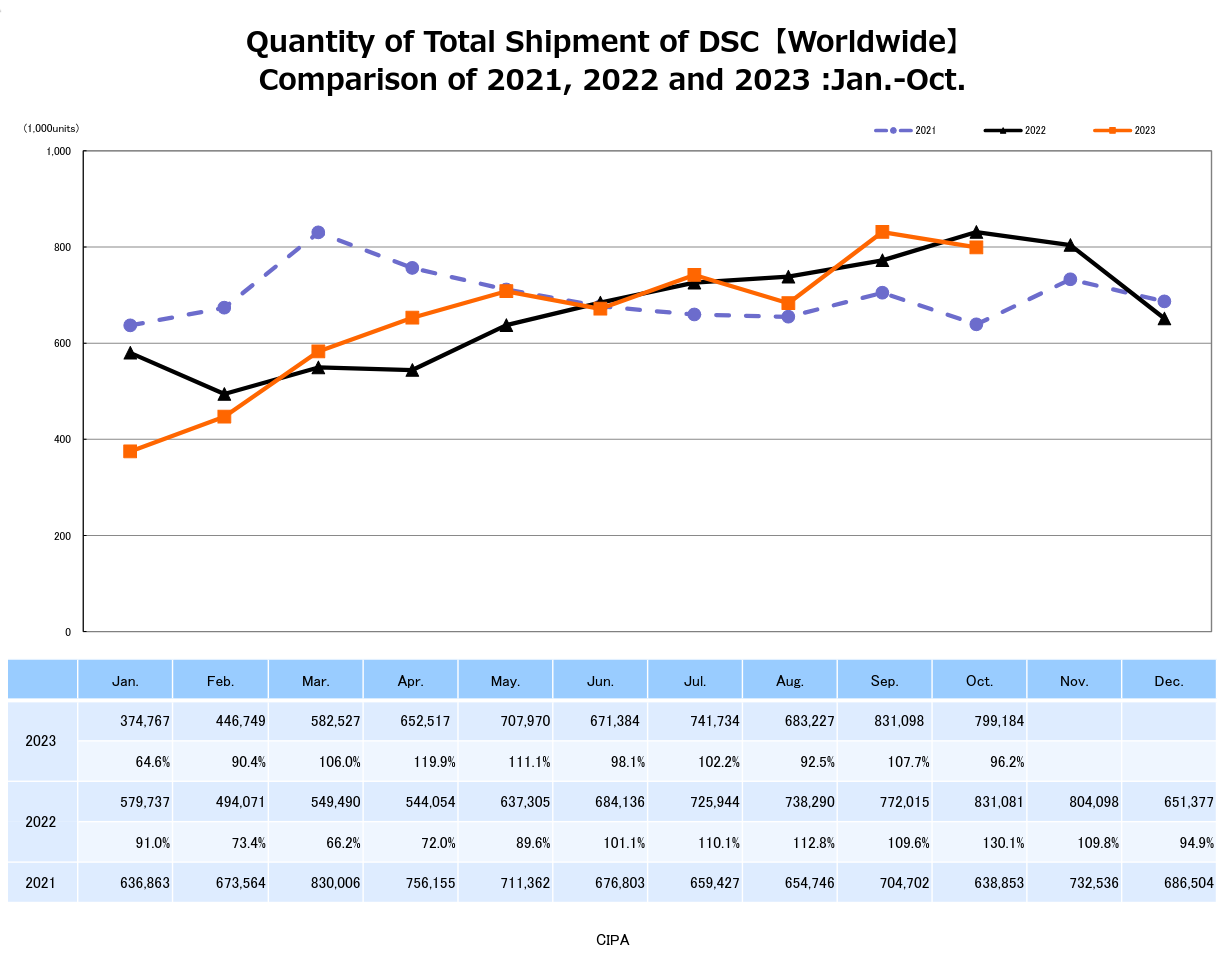

The Camera and Imaging Products Association (CIPA) has recently published (2023-12-01) its statistics on total production and shipment of digital still cameras (DSC) and the corresponding interchangeable lenses as per October 2023. CIPA member companies shipped a total of 799 184 digital cameras and 644 512 interchangeable lenses January through October 2023.

The data for the period 2021 through 2023 is relatively flat, with common, seasonal shipment changes. After years of falling sales in a tumultuous time period, with the COVID-19 pandemic, competing with smartphones while battling electronic shipment problems, the camera industry now seems to have stabilized.

Growth opportunities

The total camera market including such cameras as action cameras and industrial cameras, is expected to grow from USD 27.5 billion in 2022 to USD 39.2 billion by 2030 globally according to an analysis by the market research company dataintelo. The growth being estimated at a compounded annual growth rate (CAGR) of 7.8%

Main driver for growth in this market according to the analysts is the increasing demand for digital cameras and the growing utilization of cameras in various applications. The relatively high cost of advanced digital camera systems may though restrain the growth, according to the same report.

The DSC share of this total market is valued at USD 10.6 billion in 2023, estimated to grow at a CAGR of 6.5% during 2024-2032 and to reach a value of USD 18.6 billion by 2032, this according to a report by the market analysts at EMR.

The major regional markets for DSC are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa, with the Asia Pacific accounting for the largest DSC market share while also being the fastest growing, whereas North America dominates the market when combining the revenue share with that of other camera segments. The DSC key players include Canon Inc., Nikon Corporation, Sony Corporation, Panasonic Corporation and FUJIFILM Holdings Corporation.

The Asia Pacific region is expected to grow at a faster pace than the other regions, partially thanks to rising consumer spending on electronics products where an increasing demand for action cameras and drones being one component of growth.

Drivers for growth

The main drivers for DSC market growth are:- Increasing demand for photography as a hobby and form of expression

- The emergence of social media platforms that emphasize visual content

- The growing popularity of photojournalism and other forms of documentary photography

- The proliferation of smartphones and other mobile devices with built-in cameras

- Advances in digital imaging technology

Nikon

Thanks to the launch of its latest Z-series of cameras, such as the strong contender Z9 (forum) and adjoining Nikkor lenses while improving its micro-electronics procurement, Nikon expects a stable 2024 for its mid- and high-range cameras according to its Consolidated Report Fiscal Year 2023-03-31

Nikon also sees the fierce competition in the important mirrorless camera market as a business risk, a risk it is addressing by e.g. “optimizing production and sales processes, reforming supply chain and logistics, thoroughly reducing cost, reinforcing digital marketing, and increasing development efficiency”.